2021 Tax Credits

The IDA team is currently in the process of reconciling donations and ensuring all credits are accurately attributed to our generous donors. Throughout the reconciliation process, there may be corrections that result in 2021 tax credits becoming available. We cannot guarantee that more credits will become available; however, if you would like to be notified in the event that credits are available for purchase, please email: idataxcredit@neighborhoodpartnerships.org.

We appreciate your patience as we ensure the IDA Tax Credit is allocated with accuracy and integrity.

The Oregon IDA Initiative is hard at work helping our least served Oregonians find the safety of home, the promise of education and/or the opportunity to see their business flourish. Thank you for your generous support in 2021.

2022 Tax Credits

We are not yet accepting IDA contributions for 2022, but would love your feedback on how we can improve the process to make things easier for you. If you are willing to share your experience, please fill out our 2-minute survey.

Donor forms for 2021 donors

If you made a gift in 2021 and forgot to fill out a donor form, please follow the steps below. In addition to a donor form being required by the state to support your tax credit claim, a donor form helps us get you and acknowledgement letter in a timely fashion.

- Download our donor information form and fill it out

- Submit your completed form using our secure document transfer.

From all of us at the Oregon IDA, thank you for your support.

Support for Neighborhood Partnerships

In addition to managing the IDA Initiative, Neighborhood Partnerships is building a more equitable Oregon through programs like the Oregon Economic Justice Roundtable, Stop the Debt Trap Alliance, the Oregon Housing Alliance, and Residents Organizing for Change, all programs that build community and create concrete changes in our legislature. If you would like to support Neighborhood Partnerships’ work to help Oregonians secure housing stability and achieve financial stability, please consider making a gift this holiday season.

Tax Credits Remaining

If you donated toward the end of the year, you may receive your acknowledgement letter after January 1, 2022. This will not effect your eligibility for the tax credit. Our small team is processing acknowledgement letters as quickly as possible, and we are grateful for your patience.

Need assistance?

Check out our FAQs and/or reach out to IDATaxCredit@neighborhoodpartnerships.org with any questions!

Frequently Asked Questions

Click here to read the latest IDA annual evaluation report. Learn more about how the tax credit works. How does the tax credit work? What is my tax credit rate? How do the recent changes to the federal IRS codes impact IDA donors? What else do I need to know?

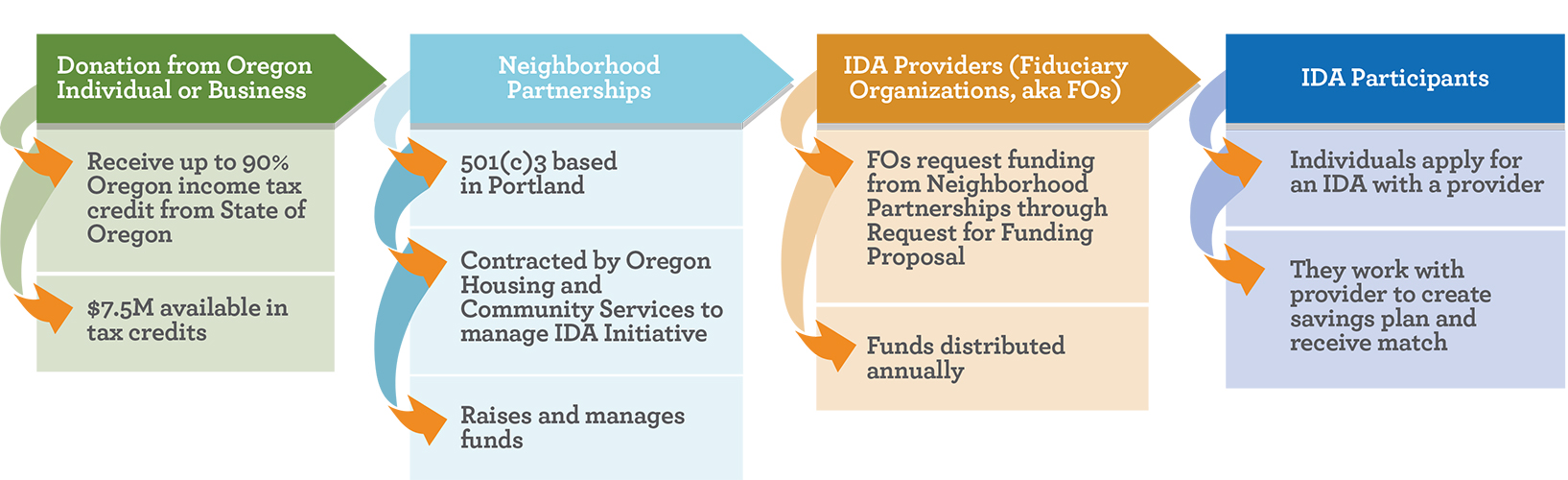

The Oregon IDA Initiative is funded by the Oregon IDA Tax Credit.

Click on image to see bigger version

Oregon contributors may receive up to a 90% tax credit on their Oregon state returns for contributions made. This means the Initiative gets $1 of investment for every 90 cents or less in tax credits. As a donor, this tax credit can be used to offset your Oregon personal income tax liability.

For contributions by check, wire transfer, or donations of stock/mutual funds, your tax credit rate is 90%. Credit card contributions will also be at 90% as we absorb credit card processing fees to encourage donations that minimize paper handling.

When you donate to the Initiative, you receive a state tax credit that can be used to offset your Oregon income tax liability. Please note that as of June 2019, the IRS has clarified that when you receive this state tax credit, you may only claim for a charitable deduction on your federal return the portion of your donation that you DO NOT receive a state tax credit for. For example, if you donate $1,000 and receive a 90% state tax credit ($900), you may only claim the 10% ($100) you do not receive the tax credit for as a charitable contribution on your federal return. You can learn more here. We strongly encourage you to consult with your CPA or tax advisor about any specific questions as we are unable to give tax advice.

Please talk to your tax advisor about the particular impacts of the Oregon IDA tax credit on your situation. Depending on your personal circumstances, and especially if you do not pay significant state income tax or property tax, benefits to you may be higher.

Read some success stories!