Turn your donation into 9x the impact: Empower Oregonians to build wealth through matched savings.

What is the IDA Tax Credit?

The Oregon IDA Initiative is a matched savings program funded primarily through a nonrefundable state tax credit. When you make a donation to the Oregon IDA Initiative, we are authorized to give you a tax credit for 90% of the value of your donation. The remaining 10% is considered a charitable contribution for the purposes of federal taxes.

Many donors choose to give donations of matured stock. Our Stock Donation Benefit Estimator tool can help show you how much you could save by giving appreciated stock to the Oregon IDA Initiative.

Use the Stock Donation Benefit Estimator

Learn More About Making a Donation

What is the IDA initiative?

The Oregon IDA Initiative brings state resources to support financial stability and wealth building among Oregonians with lower incomes, working to ensure an equitable and statewide impact in communities historically and systemically excluded from economic opportunities.

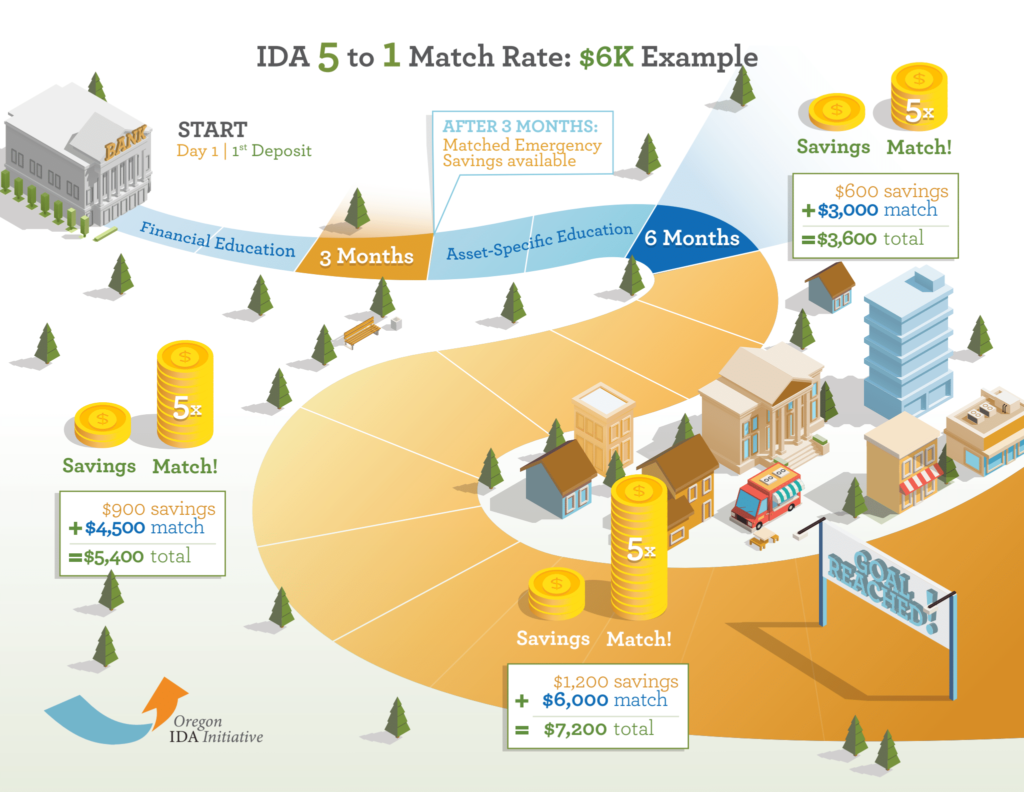

- Savers sign-up for the program and begin making monthly deposits into an IDA account with a goal in mind from buying a house to going to college debt-free.

- They receive training and coaching on financial literacy and how to succeed in reaching their financial goals.

- If they save for long enough, they get their savings matched up to 5:1.

Success Story: Tralice Lewis

With the support of an IDA, Tralice Lewis started Callie’s Custom Hat Wigs, a business that brings together her experience, expertise, and passion for serving her community and helping others. Inspired by her mother, a hospice nurse who had spent years helping people feel comfortable, as well as childhood visits to Mrs. C’s Wigs, a Black-owned business that had thrived in Northeast Portland for 30 years before its closure, Tralice seeks to create a safe space that offers education and support as people navigate deeply personal concerns related to their hair.